how does maine tax retirement income

Compensation or income directly related to a declared. Reduced by social security received.

Maine Retirement Tax Friendliness Smartasset

The state does not tax social security income and it also provides a 10000 deduction for retirement income.

. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who. The state taxes income from retirement accounts and from pensions such as from mainepers. To enter the pension exclusion follow the steps below in the program.

The top rate income tax rate also went from 66 to 59 for 2021 and it drops again in 2022 to 55 and. Arizonas exemption is even lower 2500. However maines sales tax rate is.

In Montana only 4110 of income can be exempt and your adjusted federal gross income must be less than 34260 to even qualify. First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine. Your military retirement is fully exempt from Maine state income tax.

Now that they are collecting social security the tax calculation requires an extra step. Determine the Pension Income Deduction. Chapter 115 is not considered Maine-source income so long as the work performed does not displace a Maine resident employee.

If filing jointly with spouse and your retirement income and federal AGI is each 34820 or less both spouses may exclude the lesser of taxable retirement income personally. The state taxes income from retirement accounts and from. The state taxes income from retirement accounts and from pensions such as from mainepers.

Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state. For the other pension income you get a maximum exclusion of 10000 each. Subtraction from Income You will make a manual entry in tax software for.

BUT that 10000 maximum. As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees. The 10000 must be.

All residents over 65. Deduct up to 10000 of pension and annuity income. In addition you may deduct up to 10000 of pension income that is included in your federal adjusted gross.

Maine Military Retired Pay Income Tax. One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can be as high as 715. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt.

However other forms of retirement income are taxable including ira 401k and other pension plan payments. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. Is my retirement income taxable to Maine.

The state does not tax social security income and it also provides a 10000 deduction for retirement income. They also have higher than average property tax rates. However that deduction is reduced in an amount equal to your annual Social Security benefit.

And as a plus for veterans all military pension income is tax-exempt. So you can deduct that amount when calculating what you owe in. Benefit Payment and Tax Information.

Maine allows each of its pensioners to deduct 10000 in pension income. Maine allows for a deduction of up to 10000 per year on pension income. Social Security is exempt from.

Is my military pensionretirement income taxable to Maine. Maine does not tax military retired pay. Maine does not tax military retired pay.

Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. In addition you and your spouse may each deduct up to 10000 of pension income that is included in federal adjusted gross income. Compared to other states maine has relatively punitive tax rules for retirees.

Pros And Cons Of Retiring In Maine Cumberland Crossing

Maine Retirement Tax Friendliness Smartasset

Your Complete Guide To Municipal Bonds The Motley Fool Https T Co 6d1cs6ot2m Https T Co 7bfebu Map Of America States Social Security Benefits America Map

Maine Retirement Taxes And Economic Factors To Consider

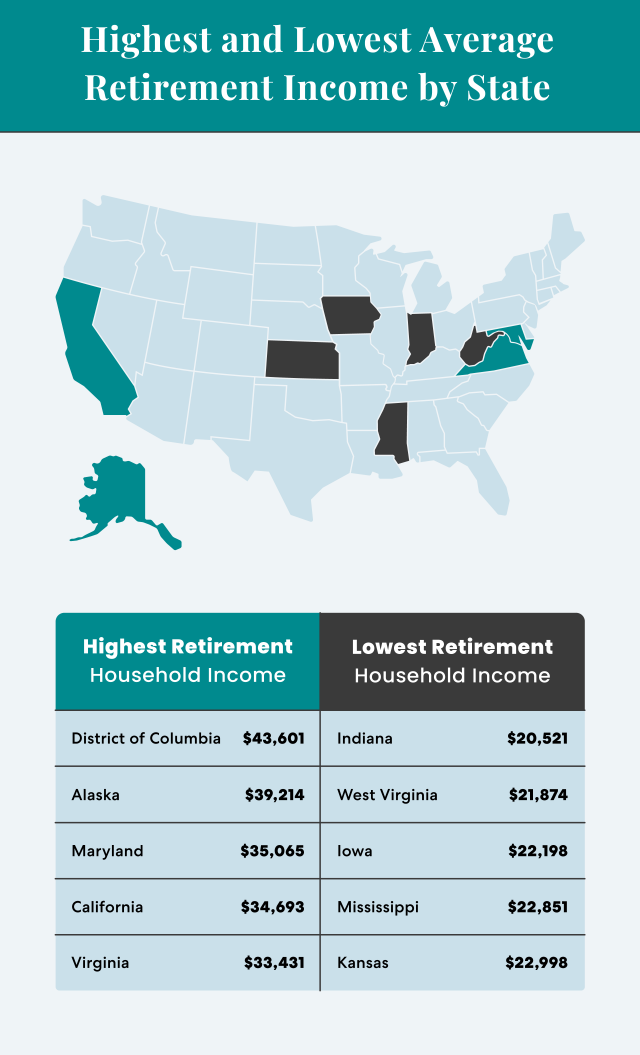

Average Retirement Income Where Do You Stand

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

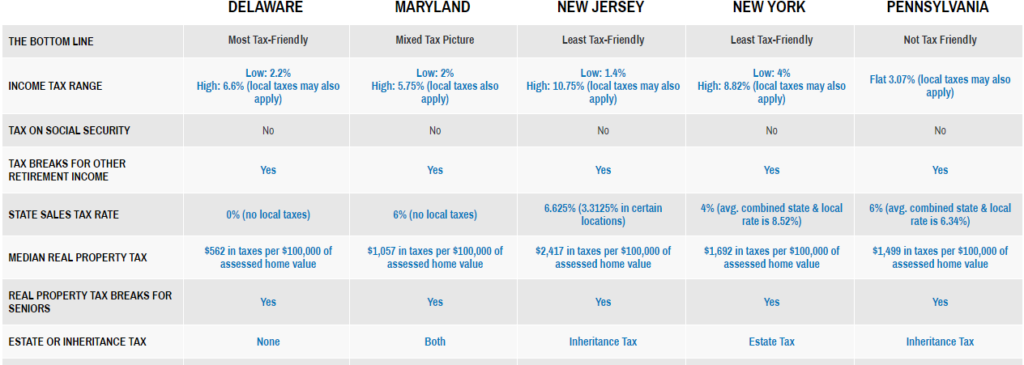

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Tax Withholding For Pensions And Social Security Sensible Money

The Best States For An Early Retirement Health Insurance Life Insurance For Seniors Early Retirement

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

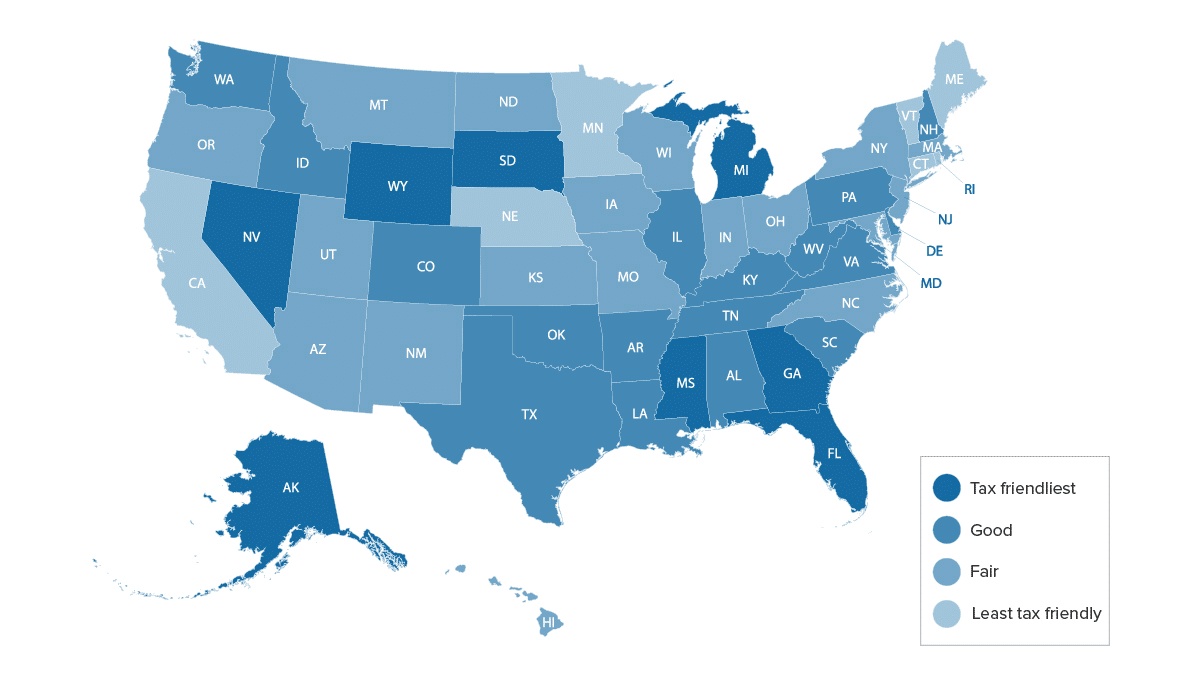

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

7 States That Do Not Tax Retirement Income

States That Don T Tax Retirement Income Personal Capital

Most Tax Friendly States For Retirees Ranked Goodlife

Hobby Income For Retirement Youtube Retirement Planning Personal Finance Advice Retirement Pension

Maine Retirement Tax Friendliness Smartasset

37 States That Don T Tax Social Security Benefits The Motley Fool

2021 Maine W9 In 2021 Employer Identification Number Income Tax Return Internal Revenue Service

Worried About Tax Fraud What Does The Irs Pursue For Tax Fraud Payroll Taxes Irs Taxes Filing Taxes